I was going through some old boxes the other day and discovered this:

Impermanence Rules

That’s the November 1988 issue of Byte Magazine – then the pre-eminent journal of do-it-yourself computing.

There are three things that come to mind right away looking at this.

Byte Magazine no longer exists.

NeXT Computer no longer exists.

And of course, Steve Jobs, who founded NeXT and co-founded Apple (AAPL), no longer exists. Rest in Peace.

Wistful Past

The world is obviously poorer for Jobs’s passing. Neither Byte nor NeXT are much mourned. Genius is eternal; any given year’s technology or media? Not so much.

Thumbing through the 488 pages of this issue of Byte is a carnival ride through a wistful past.

Here comes Microsoft (MSFT) and Compaq. There goes Radio Shack and Hayes and Gateway. Keep your hands inside the car at all times.

Printer Ribbons

At the back is an index of advertisers. It’s both amusing and revelatory that not only are plenty of advertisers gone, but also entire product categories.

Modems. Mass Storage. Printer Ribbons. (Yes, they were a thing.) And while PCs as a category are still around, of the 49 companies offering PCs for sale in that issue of Byte, I counted only five still in existence.

My favorite among the dearly departed is/was “Godspeed Computers,” a Taiwanese white-box PC case vendor that seems to have ceased to exist in the mid-2000s.

Survivors

But that’s not to say that today’s tech and its vendors are all doomed. Far from it. I think many will survive and thrive. And their stock prices – where the participants are publicly traded – have ample runway, in my opinion.

In the past couple of months, tech stocks in general and the popular “FAANG” stocks in particular have taken quite a beating.

As I type this in late November, Facebook (FB) is down 38% from its all-time high, set earlier this summer. Amazon (AMZN) is down 26%.

Are these companies headed the way of NeXT Computer? No one knows for sure of course.

Looking Ahead

Here are some quick observations about these and other tech war horses, none of which I currently own in the Crabtree Technology or Crabtree Hedged Technology portfolios:

Facebook: It’s hard to imagine anything bad happening to Facebook with its glorious business model.

But Bill Gates could probably teach Mark Zuckerberg what happens when you get crosswise with the government. Hint: your stock price stops going up. For years.

Amazon: When you consider that Amazon has only 5% market share of all retail spending in the US and that its profitability is a choice, not a goal, in my view you don’t really worry about Jeff Bezos getting distracted by all those rockets.

Apple: The company generated $60 billion in free cash flow in its last fiscal year. I think that buys a lot of time to find the successor to the iPad, its last hit product.

On Thanksgiving Day 2018, it was reported that Apple is discounting its current generation iPhone XR. In my opinion, that’s not a good sign. Canary? Meet coal mine.

Google: With social networks coming under fire from regulators, Google (GOOGL) should be thankful Google Plus was a failure and will be shut down.

Meanwhile, thanks to its core search advertising business, in my view Google remains a near-monopoly, grew its revenue 21% year-over-year in its last quarter and has 35% operating cash flow margins.

People complain that none of their other ‘moon shots’ like YouTube and self-driving cars are profitable. But I don’t see people asking Ford to sell lettuce or Consolidated Edison to drill for oil, so Google needn’t worry.

Microsoft: The company is having a heck of a second act. Thought to be irrelevant in a Web 3.0 world, the company continues to grow and remain profitable. Much credit goes to CEO Satya Nadella.

Takeaway

Of course, IBM had a second…and third…and fourth act and now that show seems pretty much over. So Microsoft shouldn’t take any victory laps in my opinion.

And what about the new technologies around which great companies and fortunes will be made? Well there’s long-term energy storage, vegetable protein, P2P mobile payments, blockchain, gene editing, artificial intelligence, autonomous robots, drones…the list goes on.

So ride those war horses as long as you can. Just don’t expect a flying car to pick you up when the ride is over.

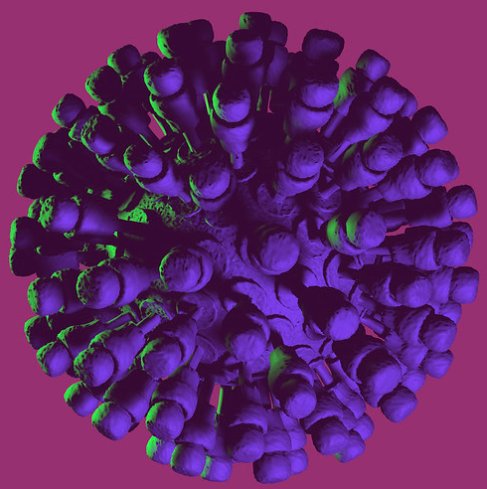

Photo Credit: J P via Flickr Creative Commons