The U.S. stock market is having a very rough October, with declines powered by worries about Federal Reserve monetary policy, rising bond yields, trade friction and the outlook for the tech sector.

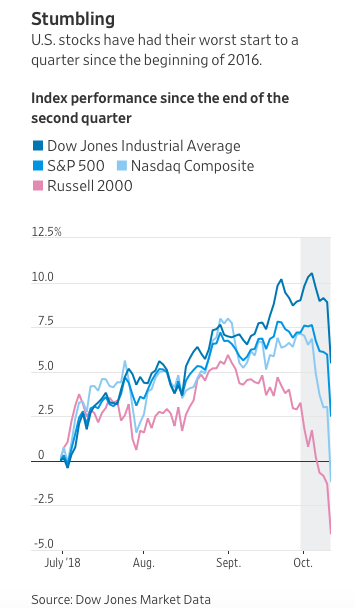

The Dow Jones Industrials Average did a faceplant on October 10, posting an 832-point decline.

More broadly, the U.S stock market is having its worst third-quarter start since the global financial crisis 10 years ago, according to the Wall Street Journal.

Defensive Strategies

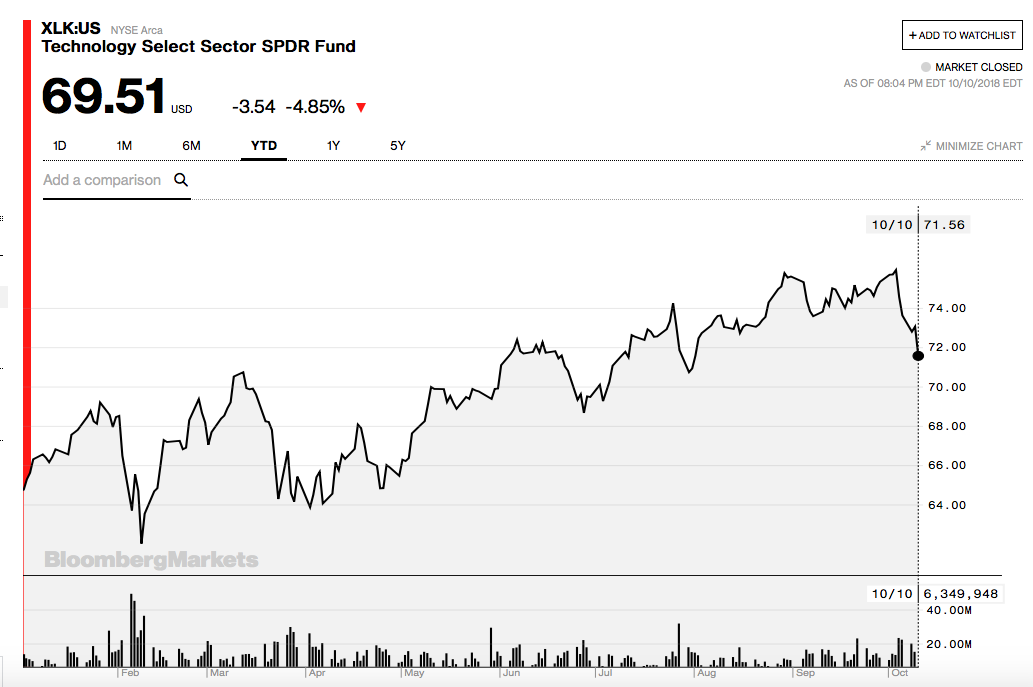

Investors have been pulling out of tech and other growth stocks in recent weeks, likely thanks in part to the recent hike in government bond yields and the Federal Reserve’s interest rate increases.

In my opinion another factor is the US-Chinese trade war. The Trump administration has slapped more than $200 billion of tariffs on Chinese goods.

Silicon Valley firms like Microsoft, Apple and Intel have big operations in China and the country is a big market as well.

Takeaway

In my view, the stock market may turn more volatile in the next few months.

With inflationary fears rising, a strong economy but a tight labor market, the Fed isn’t likely to let up on its tighter monetary policy.

The American central bank is expected to raise interest rates another quarter of a point in December.

The Fed’s more-restrictive stance may make for some unsettling times the rest of 2018.

Photo Credit: Christiaan Colen via Flickr Creative Commons