The broad stock market volatility in recent weeks has posed challenges for investors and, in my opinion, it may continue.

In my view, when looking at the CBOE Volatility Index (VIX), there actually may not be enough fear in the marketplace.

The current reading hit 27.5 as of October 27, but that compares with 29 on October 11 and 50 back in February.

VIX Index

In my view, there may be more stock market pain to come. I know it is not comforting to hear this because the S&P 500 is already 9% off its highs, while the NASDAQ is nearly down 12%.

In my analysis, I think there could be an intra-day spike to around 35 on the VIX at some point to confirm a capitulation type of moment for investors.

Downside Risk

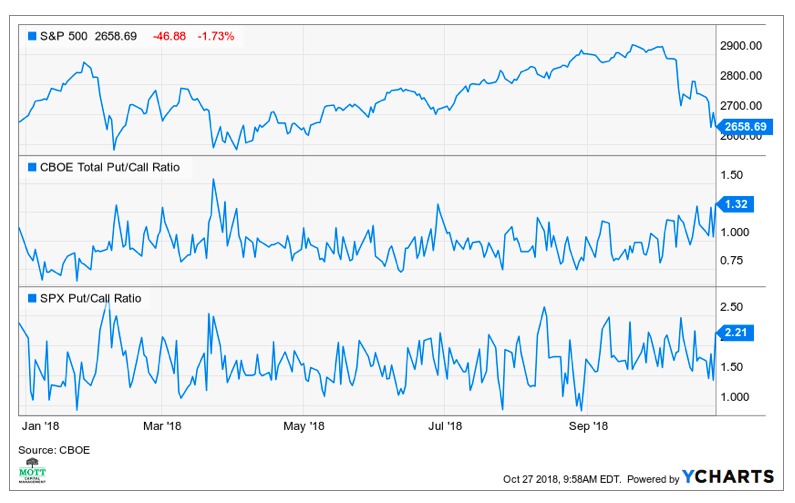

In my opinion, the put-to-call ratio also suggests more stock market downside risk. A large proportion of puts to calls indicates bearish sentiment.

In early February the S&P 500 put-to-call ratio hit about 2.75, and on Oct. 27 it is was just 2.24. In February, the total market put-to-call ratio hit 1.3, but it wasn’t until the end of March that it surged to 1.55.

It was that March reading that marked the bottom in the winter selloff.

Support Level

According to my analysis, the next chart suggests 2,620 is the next level of support, but I think we may ultimately fall to about 2,575 before we see a bottom and stock market stabilization.

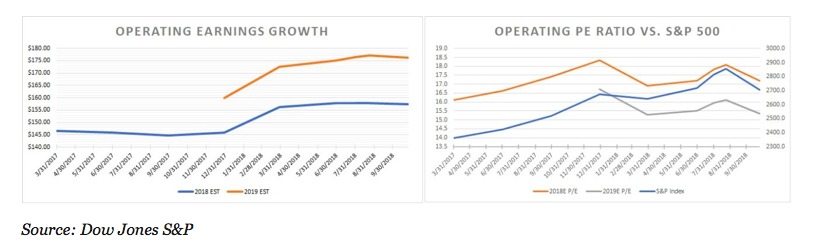

There is some good news in all of this because the price-to-earnings (PE) ratio for the S&P 500 has fallen to 15.3 based on 2019 earnings estimates.

Corporate Growth

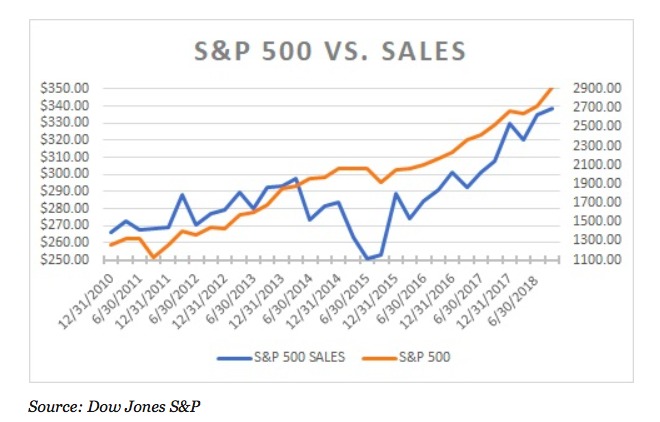

Sales growth is also expected to be strong, rising by 10% over last year and up by over 1% sequentially. Operating margins have also been expanding and are at their highest levels going back to the year 2010.

If operating margins are peaking and will decline, then that may imply that earnings estimates for next year may be too high, according to my research.

Sales Growth

Additionally, if sales growth is peaking, then that too would mean that earnings growth for next year may also be too high.

In my opinion, the best way to watch this scenario develop is to watch inflation rates, which factor into companies’ input cost, as well as US and global GDP growth to determine sales.

One key concern has been labor costs. So, in my view, investors should keep an eye on the November jobs report for signs of possible further margin erosion.

Photo Credit: David Ohmer via Flickr Creative Commons