China has always had its perma-bears like George Soros and Jim Chanos , both of whom argue the world’s second biggest economy is heading for a debt-fueled, financial crisis.

Not everyone buys their investment view on China, but there is reason to worry, according to David Lipton, First Deputy Managing Director, with the International Monetary Fund.

In a recent speech, the senior IMF official sounded the alarm about corporate debt levels in China.

Ticking Bomb

Overall, total debt has shot up dramatically since the global financial crisis in 2008 and is today equal to about 225 percent of GDP.

Of that, corporate debt is 145 percent of GDP, “which is very high by any measure,” according to Lipton.

Some private economists think corporate debt as a percentage of the total economy may be closer to 165%.

Zombies

What’s particularly worrisome is that most of the corporate debt, some 55%, is centered in the inefficient state-owned industrial sector.

There’s massive overcapacity in the nation’s government-owned Rust Belt industry and these companies are having trouble managing their debt loads.

As Lipton described it:

“These corporates are also far less profitable than private enterprises. In a setting of slower economic growth, the combination of declining earnings and rising indebtedness is undermining the ability of companies to pay suppliers or service their debts. Banks are holding more and more nonperforming loans, or NPLs. The past year’s credit boom is just extending the problem. Already many SOEs are essentially on life support.”

Dud Loans

China plans to handle the build-up of dud loans in the banking sector with debt-for-equity swaps.

Trouble is, many banks are controlled by the state and answer to political leaders, not necessarily market forces.

Unless they demand serious restructuring plans, or even allow some state firms to fail, in my opinion, it’s hard to see much progress being made.

Slowdown

In my view, turning off the credit spigot is hard for Chinese leaders at the moment.

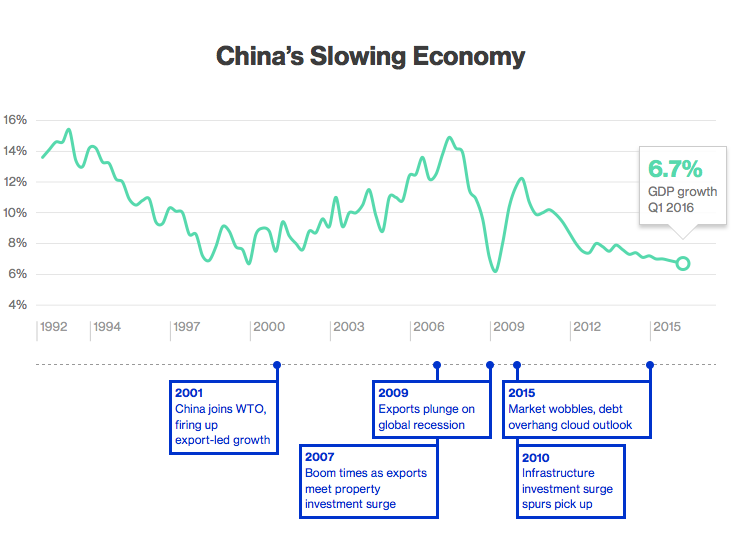

The economy is no longer growing at double-digit rates.

China’s first quarter growth of 6.7%, the slowest pace in more than two decades, relied heavily on a massive credit expansion by banks.

Takeaway

China’s debt dynamics are getting scary and it’s not just the IMF and Western investors sounding the alarm.

In March, People’s Bank of China Governor Zhou Xiaochuan publicly warned about the spike in corporate lending as a ratio to gross domestic product.

In my opinion, the burning question is whether Chinese officialdom can defuse its debt bomb before it’s too late.

Photo Credit: Alfred Weidinger via Flickr Creative Commons