The high-velocity, US corporate buyback wave shows no signs of abating in my opinion.

In the first quarter of 2016, American CEOs signed off on an epic $143 billion worth of share repurchases.

Apple (APPL) led the pack and has just doubled down after its disappointing quarterly earnings results.

The tech giant now plans to buy $175 billion of its shares by March 2018. That’s up from $140 billion.

Sugar Buzz

In recent years, other cash-rich companies such as Coca-Cola (KO), Allstate Corp (ALL), McDonald’s (MCD), Northrop Grumman Corp (NOC) and Monsanto (MON) have been praised for the willingness to return cash to shareholders.

Yet some analysts wonder if the buyback frenzy is more about giving share prices a sugar buzz in a so-so economy.

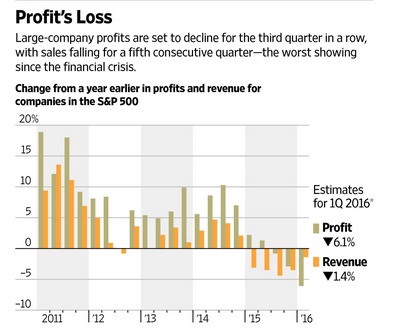

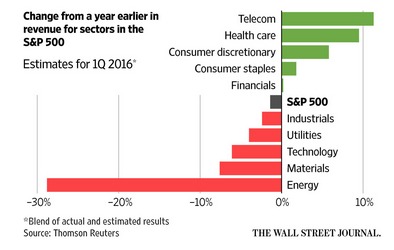

Earnings Recession

After all, in my view, US corporate profits are on track to tumble for the third straight quarter.

If so, that would be the longest slide in earnings since the financial crisis.

The culprits: A long-running energy slump and slowing global growth in China, Japan and Europe.

There is also weakness in the once-white hot technology sector.

Investment Drought

Aside from artificially propping up share prices, other critics argue that the corporate buyback mega-trend discourages CEOs from reinvesting in new and job-creating ventures.

William Lazonick, a professor of economics at the University of Massachusetts Lowell, writing in the Harvard Business Review, notes that some 449 companies in the S&P 500 index devoted 54% of their earnings ($2.4 trillion in all) to buy back their own stock.

On top of that, dividends accounted for an additional 37% of their earnings.

Takeaway

Companies are buying back their shares at a breakneck pace.

While that can be great news for investors, I think that it can also be a sign of trouble if companies aren’t investing for the long-term.

That said, this trend seems a long way from winding down in my opinion.

Photo Credit: Maureen Veras via Flickr Creative Commons