The equity market has been expanding since early 2009 but may be on its last leg in my opinion.

Given the weaker economic outlook and cyclicality of the economy, corporate earnings may start to decline in 2017 in my view.

If so, I believe that consumer cyclicals may underperform going forward as consumers delay non-essential purchases in a weaker economy.

However some specialized retailers tend to fare well in declining economies.

Budget Retailers

Such examples include TJX Cos. (TJX) and Ross Store (ROST). In my opinion, another is Five Below (FIVE).

As its name suggests, at a Five Below outlet all items are priced under $5.

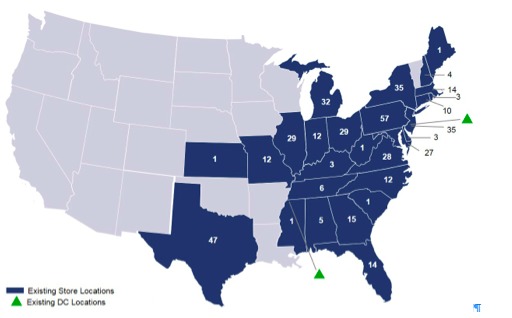

The chain has a strong following among teen and pre-teen customers and is primarily located in the eastern part of the country in 27 states, including a recently opened store in Miami.

Solid Growth

A typical store sells approximately $1.2 million annually on average and comparable store sales growth is around 3% to 4% in 2016, according to the company.

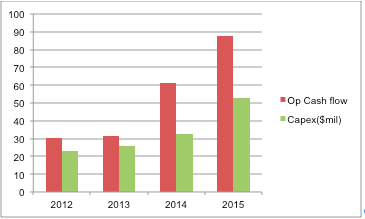

The retailer’s net revenue has grown from $297 million in 2011 to $680 million as of 2014. Profit growth has been solid as well.

Unlike other dollar budget stores, Five Below stores are trendy in my opinion and 60% of their customers come from families with annual income of $50,000 or more.

Strategy

Five Below has distribution centers in New Jersey and Mississippi, and the company is expanding westwards and may establish its first store in California in 2017.

Five Below has said in presentations that they hope to deliver 20% annual revenue growth and 20%-plus earnings growth in the foreseeable future.

The company is still unknown nationally, but word is spreading among teens and preteens, who tend to be the trendsetters.

Any investments discussed in this presentation are for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments are presented for discussion purposes only and are not a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable.

Photo Credit: Mike Mozart via Flickr Creative Commons