Though we’re on opposite sides of the Kinder Morgan (KMI) tug of war, I find that the editors of Barron’s and I tend to sing from the same songbook.

We both tend to be contrarian value investors who ignore hype—often to our own detriment.

Had I bought the hype and piled into bubbly momentum names like Facebook (FB), Amazon (AMZN) and Netflix (NFLX) this year, I’d be a lot richer.

Such is life.

Gem Stocks

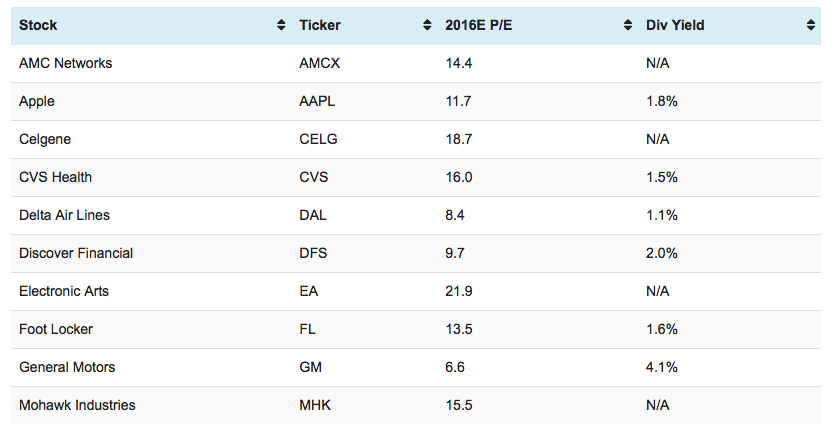

At any rate, Barron’s announced its10 Favorite Stocks for 2016 recently, and I’m going to pick through the portfolio for potential gems.

Overall, this is a portfolio I’d be happy to buy and hold for the next year. It’s diversified across industry sectors and, for the most part, very reasonably priced.

Walking Dead

That said, there are parts of the portfolio I like a lot better than others.

I’m not bearish on AMC Networks (AMCX), but the stock doesn’t strike me as particularly cheap and it doesn’t pay a dividend.

It’s also almost entirely dependent on a single show franchise, the Walking Dead.

Limited Portfolio

I’d also be reluctant to put any serious money into Celgene (CELG) for similar reasons.

A disproportionate share of its revenues come from a single drug.

And frankly, that’s a criticism of the entire biotech sphere and a reason why I tend to shy away from the sector in retirement portfolios.

iPhones & Caddies

I was pleased to see Barron’s include Apple (AAPL) and General Motors (GM). I’m long both and expect both to do well in the next year.

This is what Barron’s had to say about Apple:

“Apple will have a difficult time dreaming up a more lucrative gadget than the iPhone, and growth there looks sure to slow. The smartphone market in general is becoming saturated, and while the iPhone 6 and now 6s have offered an obvious reason to upgrade — a long-awaited shift to larger screens — it’s unclear, as always, what will make the next model a must-have.

Earnings for Apple are projected to rise at only a high single-digit pace over each of the next two years. But consider two things. First, that’s the kind of growth investors get from General Mills (GIS), which goes for 20 times earnings and carries net debt, not a cash surplus.

And consumers can switch from Cheerios to Raisin Bran without having to migrate their family photos to a new platform.

Second, investors shouldn’t count out Apple exceeding growth expectations. It has beaten earnings estimates for 12 quarters running.”

No Growth?

This has really been my point for much of the past year. Yes, Apple’s growth will slow. Of course it will.

For that matter, growth across the entire US economy looks pretty weak right now.

But at current prices, Apple is not only priced as a no-growth company… it’s priced for actual shrinkage. And that is absurd.

I did a short write-up on Apple last quarter (see Revisiting Icahn’s Apple Call After the Correction) making many of these same arguments.

Cash Rich

And I’ll repeat a point I’ve made several times this year: Apple has enough cash in the bank to sustain its dividend at current levels for years … without earning a single dime in additional profit… and this takes into account the taxes Apple would have to pay today if it were to repatriate its foreign cash.

Apple is a no brainer at these prices, in my opinion, and I’m glad to see Barron’s recommending it here.

Fast Lane

I’m also happy to see General Motors making the cut. As Barron’s writes:

“Earnings for GM are expected to jump more than 50% this year, to $4.76, as the company moves past one-time costs related to faulty ignition switches. In two years, earnings could approach $6 a share. That makes the stock look underpriced at a recent $35. Perhaps more impressive than the upside potential for earnings, however, is the potential bottom for profits during the next downturn in car sales.

GM has slashed its debt through bankruptcy restructuring and cut its US break-even point from 16 million yearly vehicles to fewer than 11 million. The recent pace of sales is over 18 million…”

As investors gain confidence in GM’s improved earnings stability, they could award the stock a valuation more befitting a healthy cyclical business.

A rise to 10 times earnings would put shares at $48 based on this year’s estimate, for a gain of over 30%.

Aging Fleet

A point I’ve made for months now is that the fleet of American vehicles is looking long in the tooth.

The average age of a car on American roads is now over 11 years.

Yes, I understand that demographics are a long-term headwind here.

But frankly, we have a lot of clunkers on the road that will need to be replaced, come what may. In the meantime, I’m happy to collect GM’s 4% dividend.

Foot Locker

Moving on, I like Discover Financial Services (DFS) and Foot Locker (FL), though I don’t love either.

I have nothing particularly negative to say about either other than that, at current prices, I don’t see them outperforming the broader market.

Though I do not currently own it, I do like CVS Health (CVS) at today’s prices. Barron’s does a pretty good job of summing up the bullish narrative here:

“The company remains at the center of trends that could keep earnings growing at a double-digit pace through the end of the decade. Increased medical-plan coverage is driving more prescriptions. So is the aging of the baby boomers. Medical plans are looking to save on drugs, and some are turning over more business to drug-plan managers like CVS’ Caremark.

Patients looking for savings, including those who remain uninsured, can take care of basic health-care needs through walk-in clinics, like CVS’ Minute Clinic chain. The stock’s dividend yield is unremarkable at 1.5%, but payments are expected to grow more than 60% cumulatively over the next three years.”

I don’t consider CVS a screaming buy, but I would expect it to at least modestly outperform the broader market starting at these levels.

Fly with Me

As for Delta Airlines (DAL) and Mohawk Industries (MHK), I would expect both to do fairly well so long as the US economy avoids a recession.

Neither wildly excite me as standalone picks, but I could see either fitting nicely in a diversified portfolio. The only stock I would say I “hate” at current prices is Electronic Arts (EA).

I’ve been wrong here before (and perhaps I’m just showing my age here), but the profit expectations for video game makers seem aggressive to me.

At any rate, my compliments to Barron’s for assembling a nice portfolio here. We shall see how it performs.

Certain of the information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Covestor believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.These investments may or may not be currently held in client accounts.The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable.

Photo Credit: DavidSandoz via Flickr Creative Commons