During the volatile third quarter, Loral Space & Communications Inc. (LORL) was added to the Prudent Value portfolio.

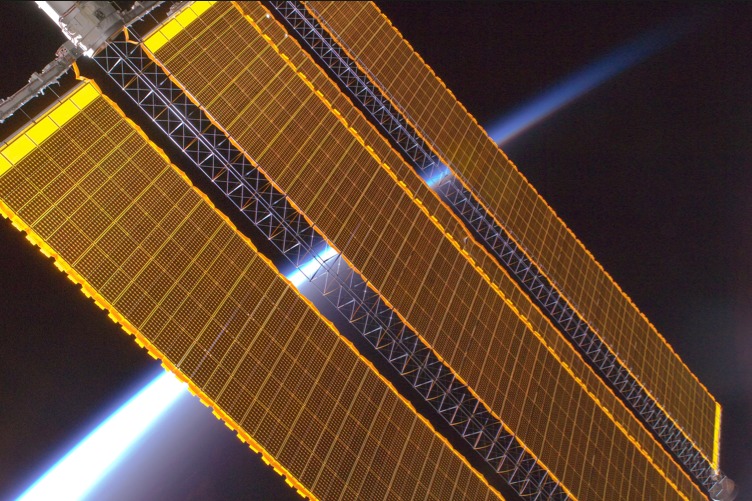

LORL, is a holding company which holds a 62.8 percent economic interest in Telesat and derives almost all of its value from the Canadian satellite communications company.

Loral in play

LORL and Canada’s Public Sector Pension Investment Board (PSP) acquired Telesat in 2007 for $3.42 billion from one of Canada’s major phone companies, BCE Inc.

In 2012, LORL sold its space systems subsidiary to MacDonald, Dettwiler and Associates Ltd, leaving Telesat as LORL’s main asset.

The other LORL asset owned is a 56% interest in XTAR, a satellite operator providing support exclusively to military and government users.

The sale of LORL and its assets broke down in June 2014 after the company failed to agree on a potential $7 billion deal with a buyer group. LORL rejected an offer from a consortium involving Ontario Teachers Pension Plan and another Telesat shareholder, PSP, which valued LORL at more $80 per share.

According to Reuters, it is not clear what the next steps will be for LORL and its top shareholder MHR Fund Management LLC, which owns a 38% stake in the company, or whether the talks could still be resumed in the future.

Meanwhile, Telesat’s operational performance has improved over prior year.

For the six month period ended June 30, 2014, adjusted EBITDA and net income was $381 and $80 million, respectively, compared to $342 and ($83 million), respectively, for the same period in 2013.

Market outlook

As we enter the fourth quarter, I remain cautiously optimistic as improving economic conditions in the U.S. are tempered by slower growth in other parts of the world.

The goal of Prudent Value portfolio is to outperform the market over the long-term while curtailing risk by investing in underlying assets of securities with strong financial positions that produce adequate (or more than adequate) returns on capital.

In my opinion, I currently have a fair amount of investments that have little or no correlation to the stock market such as low duration bond ETFs.

Continued Learning: Investing in private equity just got a lot easier

DISCLAIMER: The investments discussed are held in client accounts as of September 31, 2014. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable. Past performance is no guarantee of future results.