Rough patches in the market are a fact of life for long-term investors, sort of like getting caught in traffic during the commute. Sometimes there is just no way to avoid it.

Indeed, the stock market has hit some turbulence recently after what had been a very quiet summer so far.

A banking flare-up in Portugal last week triggered some investor jitters, although the market quickly bounced back.

This week, geopolitical tensions are in the headlines after Malaysia Airlines Flight 17 was shot down in Ukraine, and Israeli ground forces invaded the Gaza Strip.

On Thursday, the S&P 500 fell more than 1%, snapping its streak of more than 60 days without a 1% move.

So, Thursday’s sell-off might have seemed worse than it actually was for some investors because market volatility has been so subdued lately. In fact, it has been about three years since the Dow Jones Industrial Average has suffered a 10% correction.

The CBOE Volatility Index (VIX), known as Wall Street’s fear gauge, spiked more than 30% on Thursday as investors focused on Ukraine and the Middle East. It was the largest percentage gain in over a year for the VIX, which had been trading near multiyear lows.

“People are selling out of fear,” fund manager Todd Lowenstein told Bloomberg. “The market is really acute to geopolitical risk. Given where valuations are and the move lately amid all the M&A activity, when you have some geopolitical shocks, people will look for a reason to sell.”

It’s natural to be fearful when markets are selling off and investors are inundated with unsettling media updates in the 24-hour news cycle. After all, we wouldn’t be human if we weren’t moved by images of a plane crash that resulted in the death of nearly 300 people.

Yet for long-term investors, selling on fear and other emotional decisions can lead to major mistakes. Sometimes the best response is simply to do nothing.

Here are some tips to keep your head when the inevitable geopolitical shocks hit:

Corrections go with the territory

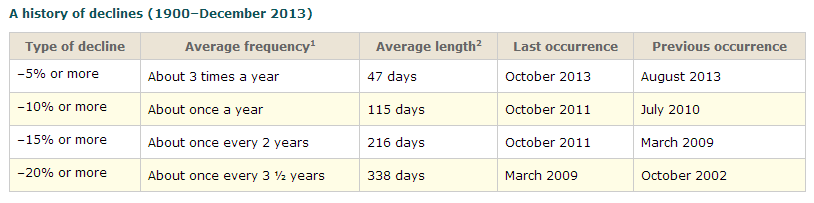

Going back to 1900, the Dow averages a decline of 20% or more every 3.5 years, according to data from American Funds.

If you’re a long-term investor in stocks, 20% corrections will likely occur every few years. The financial crisis was bad, but we’ve had relatively smooth sailing in recent years. Just remember though — this won’t always be the case.

Know your risk tolerance

Investors need to have a plan and determine how much risk they can stomach. For example, younger investors can generally take on more risk with stocks because they have time to make up losses. Conversely, retirees who need income and more conservative investments might consider a larger allocation to bonds, for example.

That’s why Covestor’s portfolio search tool asks investors about their financial situation, including investable assets, level of risk, and other factors. (See this blog post on three steps to building a smart investment portfolio.)

Keep a long-term mindset

Investing is a marathon, not a race.

Keeping your eye on your long-term goals will help prevent emotional decisions.

Stay diversified

A good way to avoid being overcome by fear when volatility rears its ugly head is owning a mix of asset classes like stocks, bonds, real estate and commodities. That way, some of your investments are zigging when others are zagging.

Diversification is sometimes referred to as the only free lunch in investing because the practice can achieve better risk-adjusted performance over longer periods.

Photo credit: Amir Farshad Ebrahimi via Flickr Creative Commons

To learn more about how Covestor works, contact our Client Advisers at clientservices@interactiveadvisors.com or 1.866.825.3005. Or you can try Covestor’s services with a free trial account.

DISCLAIMER: The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. All investments involve risk, the amount of which may vary significantly. Past performance is no guarantee of future results.