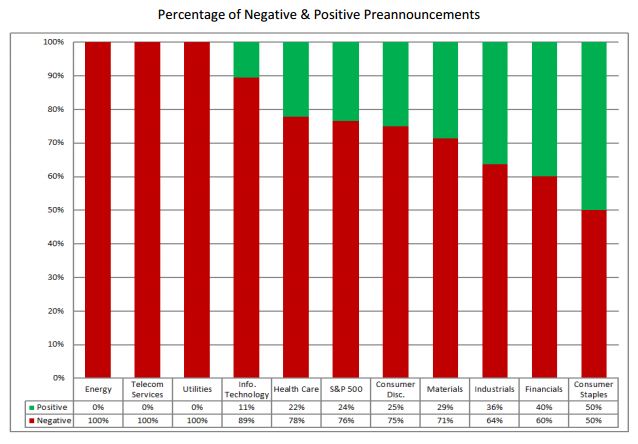

Some investment managers are having a tougher time finding bargains in the U.S. stock market with the S&P 500 up about 28% so far this year.

In particular, smaller companies as measured by the Russell 2000 have outperformed blue-chip S&P 500 stocks in 2013, leading to concerns small-caps are overvalued.

However, Jim Wright, co-portfolio manager of the Domestic Dividend portfolio on Covestor, says U.S. large-caps are also looking somewhat pricey after the strong rally this year.

He tells Financial Advisor Magazine:

“Revenue growth has been fairly limited this year and much of the earnings growth has come from continued cost cutting. We question how sustainable that is and what investors are willing to pay for that type of growth,” said Jim Wright, a financial advisor with Harvest Financial Partners in Paoli, Pa. “While 2012 and 2013 have been very good years for large-cap stocks, valuations are a bit high and we do not find them as attractive today.”

Read the full article at fa-mag.com.