Warren Buffett famously said he tries to be fearful when others are greedy. So, is it time to get concerned about rising bullish sentiment levels in the stock market?

According to the latest adviser sentiment survey from Investors Intelligence, the number of bears dropped to 14.4%, the lowest level since March 1987.

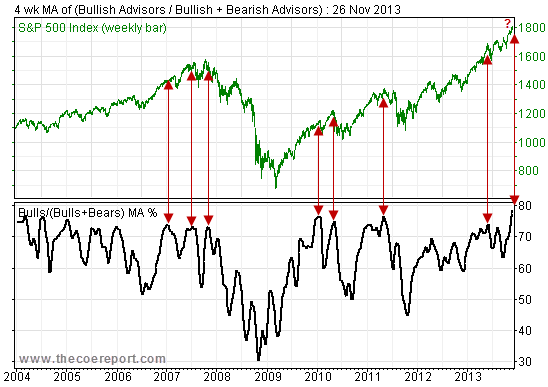

“The four week moving average of the percentage of bulls divided by the bulls plus bears, a calculation which ignores the fence sitters, has risen to its highest level in over a decade,” says Investors Intelligence technical analyst Tarquin Coe. “Bulls are abundant, bears are scarce.”

In fact, this bullish sentiment indicator has climbed to levels that have coincided with market pullbacks the past several years.

Chart: The Coe Report, Investors Intelligence

It’s easy to see why the bulls are fat and happy. The S&P 500 index is up about 30% this year to nominal all-time highs.

According to contrarian investors, upbeat sentiment is a cause for concern. Also, margin debt levels reveal that investors are borrowing record amounts against their brokerage accounts, according to The Wall Street Journal.

Bullish sentiment and margin debt levels “says nothing about where the markets go in the short term from here,” Peter Boockvar, managing director at The Lindsey Group LLC, told the WSJ. “This Fed hosted party can still have life left but I feel it’s always important to have perspective. These two data points should provide reason for an investing gut check in early 2014 in terms of how to be positioned.”

It has been over two years since the S&P 500 experienced a 10% decline from a high. Some strategists such as Ned Davis at Ned Davis Research are preparing for a significant correction sometime in 2014 due to several bullish sentiment surveys rising close to multiyear peaks. Additionally, the percentage of assets in Rydex mutual funds that are in money market accounts has dropped below the lows seen as the last bull market was topping out in 2007. In other words, market timers appear confident and are holding very low relative levels of cash.

Yet, high investor optimism is being offset by pessimism among consumers, Davis said. “We are not ready for a bear market pullback,” the strategist wrote in a recent note.

Howard Marks, the chairman of Oaktree Capital Management, recently said stock valuations are a bit stretched after the rally but not at bubble-type highs.

The bottom line is that history shows trying to guess the market’s next short-term move is extremely difficult. However, investors should keep in mind that bullish sentiment is relatively high now, and remember that the U.S. stock market doesn’t dish out 30% gains every year. With more investors recouping the losses they suffered during the financial crisis, it might be a good time to reassess their portfolios and risk tolerance as they look ahead to 2014.

Photo Credit: htmvalerio

The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. Past performance does not guarantee future results.