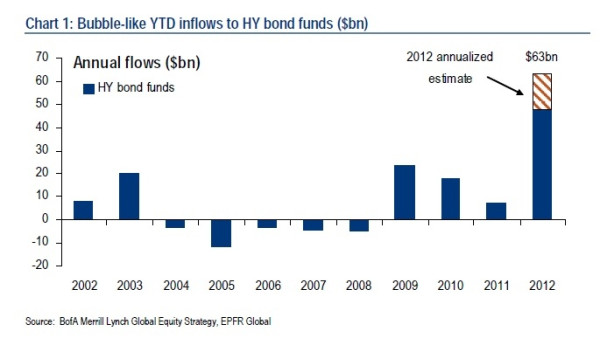

BofA Merrill Lynch’s Michael Hartnett put together this chart of what he calls “bubble-like” inflows to high yield (“junk”) bond funds in 2012:

It’s obviously been a remarkable year for high yield bond demand, boosted by extremely low U.S. Treasury rates (and the Fed’s promise to keep things that way) along with global macro concerns that leave investors skeptical of equities.

If you look at returns on high yield bonds as a class, they are good, but not that stellar year to date – here’s HYG, the most popular junk bond ETF, in 2012:

In the longer view of HYG, you see the discrepancy from Hartnett’s inflows chart – 2009 saw a huge jump in value despite much lower inflows to the sector:

Why hasn’t 2012 seen a similar, or even greater rise in HYG value? One factor, as Ben Levisohn points out, could be that the ETF was overpriced at the beginning of the year. But there’s also been plenty of supply to sop up investors’ demand. The FT reports

a nearly fourfold rise in “junk” bond issuance from the same [Q3] quarter last year to $109bn, as companies normally forced to pay closer to 9 per cent over the past decade tried to lock in substantially cheaper rates. “With risk-free rates around the world so close to zero, investors have been willing to take on a lot more credit risk to get a higher yield,” says Mathew Cestar, head of leveraged finance in Europe at Credit Suisse. “Corporates have been rushing to borrow.”

So what could go wrong here? As always with bonds, there are two main risks: default risk (the corporations you loan to don’t pay you back) and interest rate risk (rates rise everywhere, making your junk bond yield less attractive). Here’s IndexUniverse’s Spencer Bogart on the former:

If macroeconomic conditions play out in a doomsday scenario, defaults in the junk bond market could spike dramatically and cause investors to demand higher yield in a heightened risk-off environment. Another important note on default risk is that issuers of low-rated debt may overextend themselves in good times. Consequently, they face a higher risk of default when the economic environment turns negative.

And on interest rate risk:

if the Federal Reserve reneges on its commitment to suppress long-term rates, investors who were previously deterred by negative real rates may find their way back to the relative safety of Treasurys. As money flows back into Treasurys, demand for junk bonds wanes, and investors demand a greater premium over the rate offered by risk-free Treasurys.

But as the economy remains in a state of long-term repair, the Fed appears unlikely to renege. So junk bond investors (and corporate borrowers) are betting on things continuing in this Golilocks-like ‘not too hot, not too cold’ state – corporations (even weaker ones that need to pay high borrowing rates) generally able to produce the cash flows to pay back their reasonable debt levels, within an tepid economy that requires low interest rates from monetary policymakers.

But if either one of those assumptions proves untrue sometime in the near future, watch out in junk bond land. Goldie won’t eat if the porridge is cold, or with a burned tongue. Keep that in mind if you’re tempted to join her high yield bond party.

BAML chart via Things that make you go ‘hmmmm’. “Bubble-like … on Twitpic.