Covestor model: TenStocks

Disclosure: Long AVEO, BAC, HTCH

Watching the Covestor TenStocks portfolio during the last few months has been about as exciting as watching paint dry. There hasn’t been a lot of action and we’ve drifted lower since our late March high. But investing is not the right place to look for excitement. Those looking for thrills should try something like this.

In investing, survival is job number one–not entertainment. We believe that these performance ‘dead zones’ are often a precursor to a move up and that if we keep building value into the portfolio, at some point the sheer pressure of that value will force a move upward. And despite the recent stretch of boredom, as of August 30, 2012 we are still up around 23% year to date. That’s roughly double the pace of the S&P 500 Index (SPX).

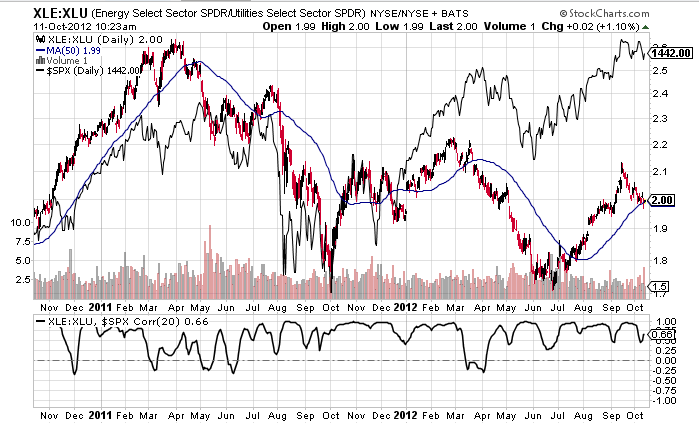

At the moment, as Jonathon Tunney of Atlas Capital stated in a recent post, in today’s market safety is expensive and risk is relatively cheap. We couldn’t agree more. Danger always lies where there is a crowd. Today the crowd thinks safety is safe. We believe that the price people are paying for yield today is ridiculous and that almost anything that pays a dividend is overvalued.

On the other end of the investing spectrum, to borrow a line from Brad Pitt’s and Michael Lewis’ Moneyball, the TenStocks portfolio is like an island of misfit toys. We have Hutchinson Technology (HTCH), a near bankrupt company that spent close to their last dime building a factory in a flood zone only to see it eyeball deep in water within months.

We have Bank of America (BAC), arguably America’s most disliked company. Everyone and their dog know BAC will never make another penny. And we have Aveo Pharmaceuticals (AVEO), where the market says the FDA will never approve their cancer drug.

So why do we have a portfolio of misfit toys? Because in each case we believe market perception is wrong and the stocks offer an outstanding risk to reward profile. Hutchinson Technology is priced by the market as a dead man walking. Yet last month they hired a new CEO and seven insiders including the new CEO bought stock in the company at a fraction of stated tangible book value.

We believe that Bank of America will, probably within a year, begin buying back stock, increasing their dividend, or both. In 2013, we believe BAC will go from a market duckling to a market darling.

We believe that Aveo’s renal cell carcinoma drug Tivozanib will almost certainly get approved. In early 2012 the FDA approved Pfizer’s (PFE) Axitinib (brand name: Inlyta). We believe that Tivozanib is superior in both efficacy and safety.

Sometimes boring is good but it can also be lonely. You’re far from the madding crowd and nobody agrees with you. But that’s where opportunity is found. Right now the closest thing to safety may very well be a touch of patience and some perceived risk.