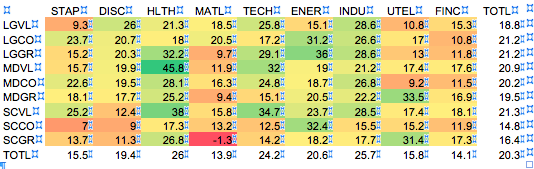

What’s been working recently? What hasn’t? The following heat map shows annual performance through May, 2014 for U.S. style-sector stock groupings, and color codes winners (green) and losers (red).

The big winner has been mid-cap value stocks in the healthcare sector with a 45.8% return. The biggest loser has been small-cap growth stocks in the materials sector, losing 1.3%.

Taking a wider view, style performance has been clustered around 20%, with the exceptions of small-cap core at 14.8% and small-cap growth at 16.4%. By contrast sector returns have been dispersed, with healthcare and industrials earning 26%, while materials and finance have lagged with 14% returns.

Here’s how to use the table above. If you believe in momentum, buy the recent winners, and short the losers. If you believe in regression to the mean, you’ll do just the opposite. Is a 45.8% return a sign of more to come, or an extreme that will correct? You are the judge.

Disclaimer: All investments involve risk and various investment strategies will not always be profitable. Neither the information nor any opinions expressed constitutes investment advice and is not intended as an endorsement of any specific portfolio manager. Past performance does not guarantee future results.