by Michael Tarsala, CMT

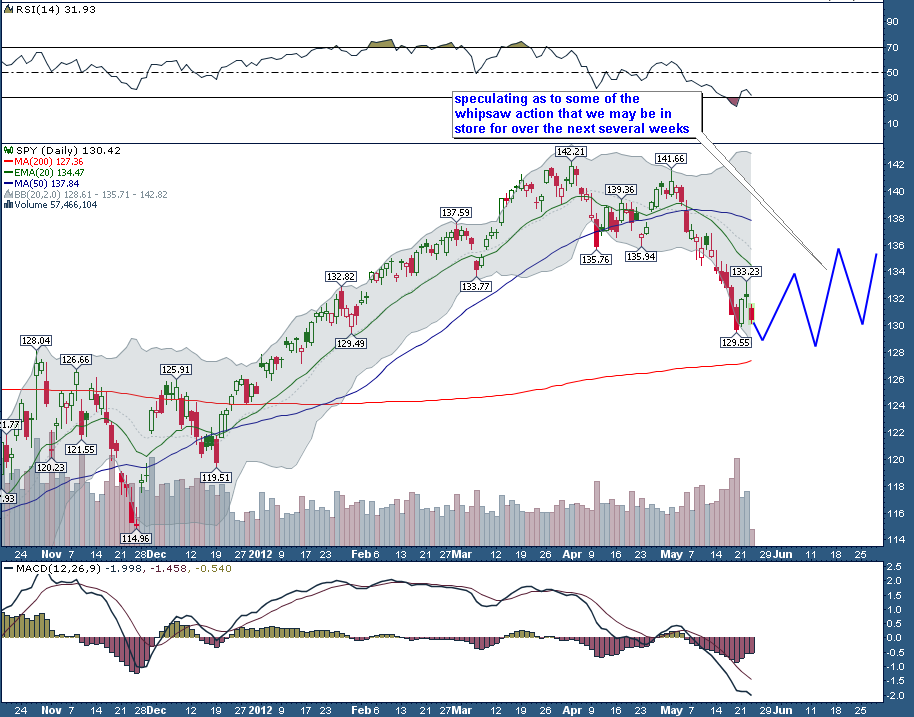

Robert Sinn, “The Stock Sage”, is making the case for whipsaw market action in the weeks ahead.

His expectation is for generally sideways trading within the big picture.

Yet within that range, head-spinning volatility is possible, amid news and rumor-based market moves emanating from Europe.

This is what it might look like:

Source: RobertSinn.com

Whipsaw action is not always a threat in the long-haul. But it can be when investors begin to make wrong-headed, emotional decisions in those periods.

Following are a three tips on how to survive a potential whipsaw market:

1) Stick to your strategy — unless your manager underperforms in tough times.

A good manager will have you positioned in less volatile investments and ones that will pay you higher dividend ahead of a whipsaw. Again, in the long-term, a whipsaw generally moves sideways, so it’s generally a good idea to stick with a long-term strategy.

The only time you want to switch is if you have a manager that has a track record of underperforming in downtrends. For long-term performance, beating the market in a downtrend is often more important than beating it in an uptrend. The reason is simple: It’s hard to make up the big losses.

Ideally, you were set up before the current decline with a manger that tends to have low max drawdowns. That is, their strategy has done less bad than the overall market in past big declines.

2) Keep your cool.

Charles Sizemore, manager of the Tactical ETF model, has a timely ode to staying cool in today’s blog.

We humans are instinctively herd animals, and we tend to panic when we see others around us panicking. We lose our independent judgment and we freeze in fear at exactly the moment we should be buying aggressively.

Knowing that, it’s important not to sell at the wrong time — which speaks to the third and final point:

3) Pay attention to the market’s cues.

Raymond James Strategist Jeffrey Saut thinks a “gradual re-accumulation” of investment positions is the right strategy, and that a tradable market bottom is at hand.

But don’t take anyone’s word at face value — even someone as well respected as Mr. Saut.

A drop in market volatility will help let you know when it’s time to get aggressive with investments again. It’s a strategy employed by managers including Michael Arold, who runs the Technical Swing model.

He explains about the benefits of watching volatility for cues here.